Indian SaaS business to grow from US$8bn in 2021 to US$100 bn by 2026, according to Chiratae Ventures-Zinnov Report.

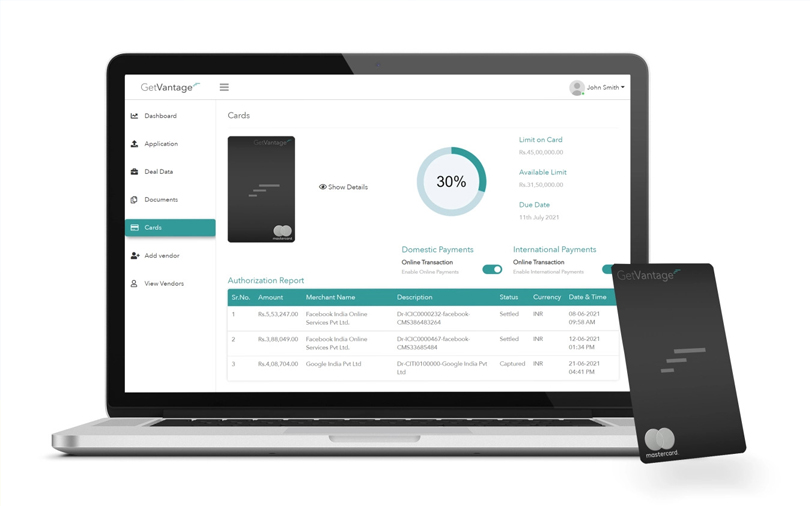

GetVantage, India’s market-leading Revenue-Based Financing fintech growth platform for digital businesses, today announced it is expanding its core areas of focus beyond the D2C space to harness the massive and growing B2B SaaS opportunity. GetVantage’s financing platform provides equity-free financing to SaaS companies in the form of an instant cash advance.

SaaS customers can leverage their predictable revenue for on-demand access to non-dilutive capital that grows with them.

Indian SaaS has grown at an accelerated pace in recent years with 1,150+ active firms driving over US$ 8 billion revenues in 2021, and is estimated to reach over US$100 billion in revenues by 2026, according to the Chiratae-Zinnov India SaaS report titled, “India SaaS – Punching Through the Global Pecking Order.” Currently, B2B SaaS & subscription-based companies make up over 25% of the GetVantage portfolio. These businesses have seen a 150% average revenue increase within a few months of using GetVantage’s capital gateway solution.

Over the last few years, revenue-based financing has exploded in popularity. More and more SaaS companies are looking away from outsized early funding to favor new alternative funding models that not only fuel growth but also allow founders to maintain control and ownership of the company. As a fundamentally non-dilutive growth capital option, it is the optimal solution for SaaS and other subscription-based models that have predictable, recurring revenues. With GetVantage, founders can make flexible monthly payments that are designed to accommodate the natural variance in the company’s revenue without demanding a fixed amount, high-variable interest rates, collateral,

personal guarantees, or equity.

Dr. Rashi Gupta, Founder & Chief Data Scientist, Rezo.ai, a leading AI-Powered Contact Center who turned to revenue-based financing to double down on growth said, “With GetVantage there’s no guessing, pitching, dilution, or cash flow impact to our business. Being able to access capital upfront when we need, it while offering more flexible payment terms to our clients is invaluable. At Rezo, we’re always looking at innovative ways to supercharge growth. Working with GetVantage, we’ve been able to scale without dilution by financing our SaaS receivables.”

Bhavik Vasa, Founder & CEO, GetVantage, said, “Modern businesses of all sizes need modern capital solutions. GetVantage helps SaaS companies to leverage their biggest asset: recurring revenue streams. The fast-evolving and growing funding requirements for Indian SaaS businesses present an outsized opportunity. With spending on digital transformation set to continue, we expect to fund 100s of SaaS and Subscription-based businesses which will make up over 35% of our revenue over the next 12 months.”

“GetVantage has helped us unlock our potential and grow on our terms by shortening the cash-to-cash cycle. Their all-digital onboarding and frictionless process through funding have been instrumental in helping our business grow at a faster pace in the past 6 months,” said Mr. Anish Popli, Founder & CEO, of Procmart, a leading digital marketplace. “The fundraising landscape is changing in favor of founders – and GetVantage feels like the future.

SaaS financing via GetVantage provides entrepreneurs the ability to grow on their terms and on their timeline; with a flexible form of growth capital to catalyze scale without dilution. Business owners no longer need to waste time and resources on fundraising and can instead get access to capital on-demand.

About GetVantage

GetVantage is India’s leading Revenue-Based Financing platform providing fast, fair, flexible equity-free capital to digital SMEs. Launched in 2020 by seasoned fintech entrepreneur Bhavik Vasa and Tech & Ops veteran Amit Srivastava and headquartered in Mumbai, GetVantage makes data-driven investments up to US$ 500k to hypercharge growth for digital brands. Built by founders for founders, the platform provides equity-free funding for marketing, inventory, logistics, and other recurring capex to businesses across e-commerce, D2C, ed-tech, F&B, SaaS, and many more. In early 2021, GetVantage launched founders for founders, an initiative to give back to the growing community of founders and entrepreneurs. The company recently announced a US$36m strategic growth round led by Varanium Nexgen Fintech Fund, DMI Sparkle Fund, and returning investors Chiratae Ventures and Dream Incubator Japan.

Other new investors who participated in this round include Sony Innovation Fund, InCred Capital, and Haldiram’s Family Office, amongst others.

About Procmart

Procmart is a B2B marketplace that connects buyers and sellers through an easy-to-use application, enabling the buyers to procure effectively. Launched in 2015, it provides an ecosystem that connects a variety of stakeholders through an easy-to-use interface. Purchase order management, contract administration, master data management, e-catalog management, compliance tracking, sourcing support, market intelligence, contracting, tail spend management, KPI, and category management are amongst the key services offered by ProcMart.

About Rezo.ai

Rezo.ai is an AI-Powered CX Cloud For Enterprises – Rezo partners with enterprises to transform the customer experience, improve agent productivity and operationalize real-time intelligence.

Note: The article was originally published on