Summary: In this blog post, we explore the critical role of MSMEs in India’s economic growth and the challenges they face in accessing formal credit. We discuss the significance of the Key Facts Statement mandated by the RBI in enhancing transparency and empowering MSME borrowers. We delve into the following sections:

- What is a key facts statement?

- Key components of the key facts statement

- Addressing challenges faced by MSMEs

- The role of the key facts statement in empowering borrowers

- Benefits of the key facts statement for MSMEs

- Broader implications of the key facts statement initiative

- Advancing financial inclusion through transparent lending practices

Micro, Small, and Medium Enterprises (MSMEs) play a pivotal role in driving India’s economic growth. Despite their significant contributions, these enterprises often struggle to access formal credit due to the informal nature of their operations. Banks and financial institutions face challenges in assessing the creditworthiness of MSMEs, primarily due to limited financial information and historical cash flow data. This information asymmetry poses hurdles to extending affordable financing to these vital economic contributors.

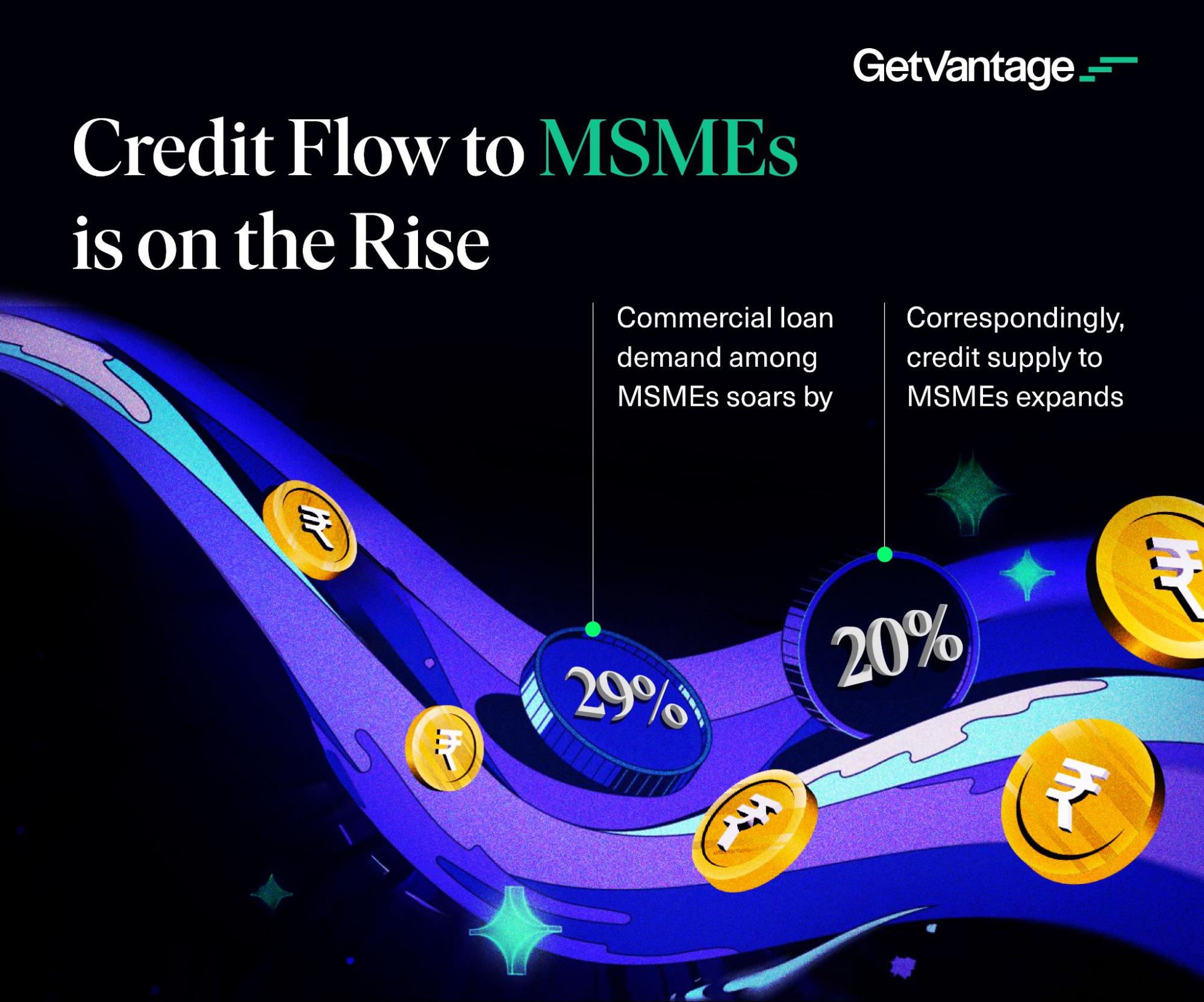

According to a recent Redseer-GetVantage report, the credit demand from digital SMEs alone is projected to soar to USD 570 billion by 2025. Recognising the critical importance of MSMEs in India’s economic landscape, the government has introduced various supportive measures to facilitate their growth and development.

One such measure aimed at enhancing transparency and empowering MSME borrowers is the Key Facts Statement (KFS) mandated by the Reserve Bank of India (RBI). The KFS serves as a crucial tool for borrowers to gain a clear understanding of loan terms and conditions, enabling them to make informed financial decisions.

The RBI’s announcement on April 15, 2024, further highlights its commitment to safeguarding the interests of MSMEs. Effective October 1, 2024, all lenders will be obligated to furnish a KFS to borrowers, detailing essential loan agreement terms for both retail and MSME loans. This initiative aims to standardise loan disclosures, including comprehensive information such as the all-inclusive interest cost, type of interest rate (fixed, floating, or hybrid), and Annual Percentage Charge (APR).

What is a key facts statement?

A key facts statement is a simplified document mandated by the RBI that summarises key loan terms, charges, and interest rates in a clear and understandable format. It serves as a valuable tool for borrowers, providing them with essential information about their loan agreements in a standardised manner. The KFS aims to enhance transparency and promote financial literacy by presenting complex loan details in simpler language, enabling borrowers to make informed financial decisions.

The KFS is specifically designed to empower borrowers, including retail and MSME borrowers, with critical information about their loans. It distils complex loan agreements into easily digestible content, enabling borrowers to navigate through the terms and conditions more effectively. By presenting key facts in a standardised format, the KFS facilitates better decision-making and helps borrowers understand the financial implications of their loan commitments.

“Now, it has been decided to mandate all REs to provide the KFS to the borrowers for all retail and MSME loans. Providing critical information about the terms of the loan agreement, including all-inclusive interest cost, shall greatly benefit the borrowers in making an informed decision.”

– Shaktikanta Das

Governor of the Reserve Bank of India

In essence, the key facts statement promotes fairness and accountability in the financial services sector. By providing borrowers with clear and comprehensive information, the KFS empowers them to engage more confidently in financial transactions and safeguards their interests in the borrowing process.

Key components of the key facts statement

The KFS includes critical information that borrowers need to know before committing to a loan.

It typically covers:

- Loan amount and tenure: The statement specifies the principal amount sanctioned by the lender and the repayment period agreed upon.

- Interest rates and charges: This breaks down the interest rates applicable to the loan, including any processing fees, prepayment penalties, or other charges.

- Type of interest rate: Specifies whether the interest rate is fixed, floating, or a combination (hybrid) of both.

- Repayment terms: Outlines the repayment schedule, including the frequency of payments (e.g., monthly, quarterly) and the mode of repayment (e.g., via direct debit or online transfer).

- Collateral requirements (if applicable): Details any security or collateral that the lender may require for the loan.

- Other terms and conditions: It further summarises additional clauses and conditions that could impact the loan agreement, such as prepayment options, loan restructuring provisions, and default consequences.

Addressing challenges faced by MSMEs

MSMEs often encounter significant barriers when seeking traditional financing avenues. Factors such as minimal credit history, lack of collateral, and complex application procedures pose challenges for MSMEs, creating opportunities for predatory lenders to exploit their financial vulnerabilities and urgent needs.

Predatory lending practices involve imposing exorbitant interest rates and undisclosed fees, masking the true costs behind seemingly attractive advertised rates. These lenders employ deceptive marketing tactics, promising quick approvals and lenient terms while concealing risks and expenses.

The role of the key facts statement in empowering borrowers

To protect borrowers and ensure informed financial decision-making, the key facts statement includes loans offered by scheduled commercial banks to individual borrowers, digital lending by regulated entities, and microfinance loans.

The KFS presents key facts of a loan agreement in simplified language and a standardised format, defined as “legally significant and deterministic facts” that aid MSME borrowers in making informed financial decisions. The statement, valid for a specified period, allows these borrowers to review and agree to loan terms.

Notably, regulated entities are prohibited from imposing fees or charges not disclosed in the key facts statement without explicit borrower consent, highlighting the document’s importance as part of the loan agreement’s summary box.

Benefits of the key facts statement for MSMEs

The KFS initiative introduced by the RBI offers several advantages to MSME borrowers, promoting transparency and informed decision-making.

- Enhanced transparency: The key facts statement simplifies complex loan terms, making critical information easily understandable for MSME borrowers. This transparency empowers MSMEs to make informed borrowing decisions, reducing the risk of entering into unfavourable loan agreements.

- Improved financial planning: Clear disclosure of repayment terms, interest rates, and associated costs enables MSMEs to plan their finances more effectively. Understanding the total cost of borrowing upfront allows MSMEs to avoid unexpected financial burdens and manage cash flows efficiently.

- Reduced vulnerability to predatory lending: Standardised loan disclosures through the KFS mitigate the risk of falling prey to predatory practices. MSMEs are less susceptible to deceptive marketing tactics and hidden charges, ensuring fairer lending transactions.

- Facilitates comparison: The key facts statement enables MSMEs to compare loan offers from different lenders more efficiently, fostering healthy competition that may lead to better loan terms and lower costs for borrowers.

- Clarity on loan terms: MSMEs gain clarity on key loan terms such as interest rates, fees, and repayment schedules. This understanding empowers borrowers to negotiate better terms with lenders and seek alternatives if necessary.

- Compliance and protection: Mandating the KFS ensures lender compliance and provides a layer of protection for MSME borrowers. Fees or charges not disclosed in the KFS cannot be imposed without explicit consent, safeguarding MSMEs from unexpected financial obligations.

Broader implications of the key facts statement initiative

The implementation of the key facts statement mandated by the RBI extends beyond empowering MSME borrowers and enhancing transparency in lending practices. This regulatory initiative holds broader implications for the financial ecosystem and aligns with key regulatory objectives aimed at promoting stability, fairness, and consumer protection.

One significant implication of the KFS initiative is its impact on regulatory compliance and risk management within the financial sector. By standardising loan disclosures and mandating comprehensive information in a simplified format, the KFS facilitates greater transparency and accountability among lenders. This, in turn, enables regulators to monitor lending practices more effectively and identify potential risks associated with predatory behaviours or unfair terms.

Moreover, the key facts statement initiative promotes financial literacy and consumer empowerment by fostering a culture of informed decision-making. MSME borrowers, equipped with critical loan information presented in a clear and understandable manner, are empowered to navigate the financial landscape with confidence. This not only reduces the vulnerability of borrowers to exploitative practices but also cultivates trust and integrity in the lending process.

The key facts statement initiative also showcases the RBI’s commitment to fostering a robust and inclusive financial ecosystem that supports the growth and development of MSMEs. By promoting transparency, accountability, and fair lending practices, the key facts statement contributes to a more resilient financial ecosystem that aligns with broader national economic objectives.

Advancing financial inclusion through transparent lending practices

The key facts statement initiative by the RBI represents a significant step towards empowering borrowers and fostering transparency in lending practices. By mandating lenders disclose essential loan details in a simple and accessible format, the KFS enhances consumer protection and promotes responsible borrowing. This initiative not only empowers MSMEs with critical loan information but also contributes to broader financial inclusion objectives.

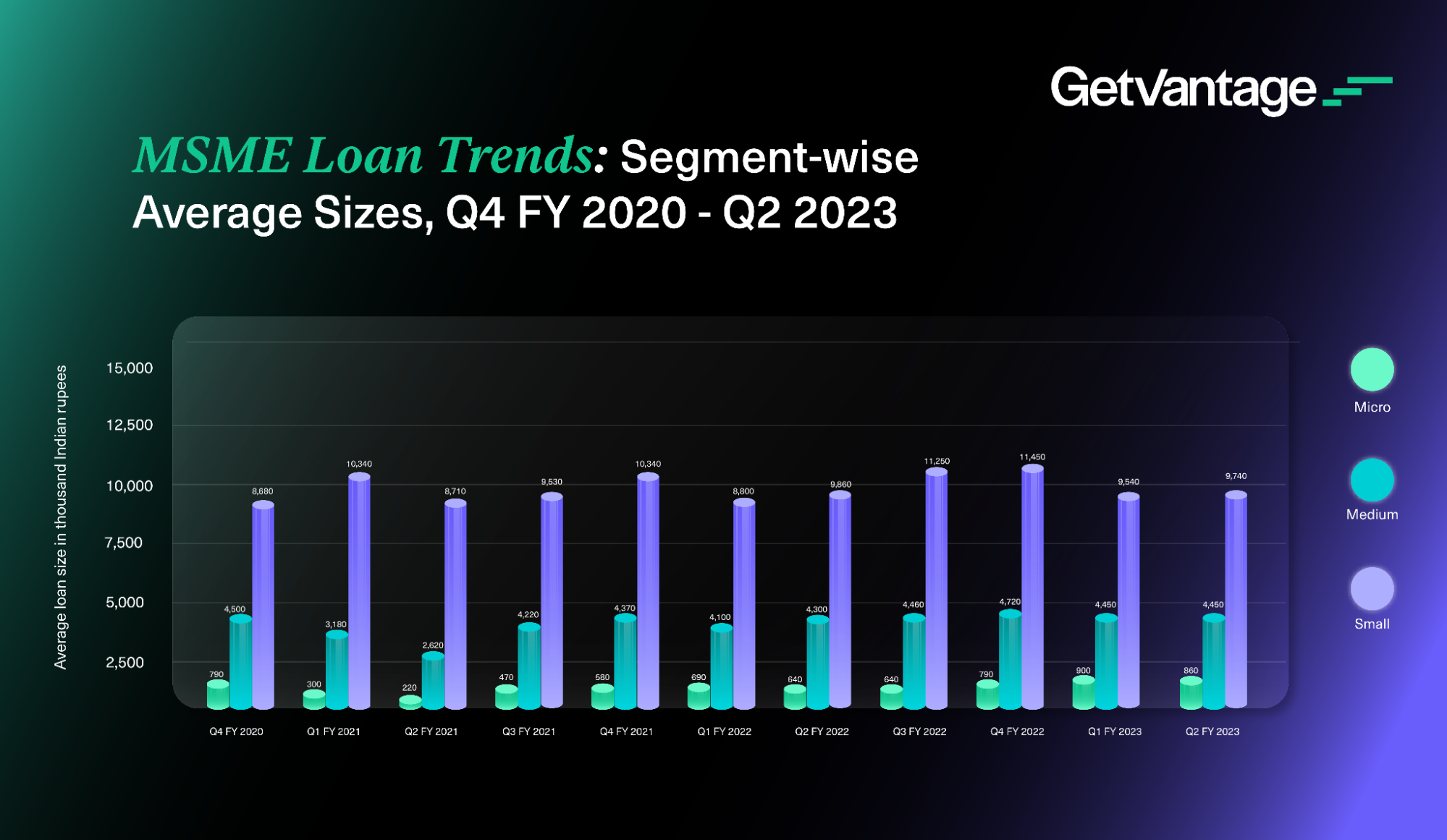

Source:https://www.statista.com/statistics/1364212/india-average-loan-size-of-msmes-by-segment/

Looking ahead, the integration of technology and regulatory innovations like the KFS is poised to reshape the landscape of financial services in India. As FinTech solutions continue to evolve, leveraging advanced data analytics and artificial intelligence, MSME borrowers will benefit from more personalised and tailored alternative financing options. This futuristic outlook envisions a financial ecosystem where transparency, accessibility, and inclusivity converge — empowering tomorrow’s entrepreneurs to thrive and contribute to India’s economic growth.