As a startup or a small business looking to raise capital, your searches have so far been dominated by Venture Capital and Bank Loans. Of late though, there are more than a few alternative financing solutions that might be an even better fit for your business. One of them, is Revenue-Based Financing.

This article is your Ultimate Guide to Revenue-Based Financing: perhaps the most data-driven, founder-friendly, and frictionless alternative financing solution out there: Revenue-Based Financing.

We’ll be covering the what, how, and why of it all. That should tell you all you need to know about the model.

Let’s dive right in.

What is Revenue-Based Financing?

It’s quite self-explanatory you’ll see.

Revenue-Based Financing (RBF) is an alternative investment model wherein a business raises capital based on a data-driven projection of its future revenues.

The model doesn’t require founders to dilute equity and control in their business. Neither does it ask founders to put up collateral or personal guarantees. The investor recovers the amount invested as a share of the business’ future revenues. That amount typically includes the principal amount plus a flat fee.

In a nutshell… that’s it.

The model adopts the best of features from both, equity and debt financing. Even though an RBF deal is typically structured like a debt instrument, the investor’s upside is linked to business performance; making them risk and reward partners.

Of course, there are a few nuances to the model but they’re rather straightforward. There are 3 major considerations to a Revenue-Based Financing deal:

- Funding Amounts: The ticket sizes for RBF deals are vast in range. In fact, that’s what makes the model suitable for businesses across the spectrum. You could raise between ₹20L (~$25k) and ₹2 Cr (~$2.5M). based on the revenue size and profitability of your business.

- Revenue Share & Fee: Every RBF termsheet typically includes a pre-determined revenue share % and a flat fee. A business’ total amount repaid includes the principal amount plus this fee.

- Repayment Tenure & Pattern: Again, it’s all in the name. Your repayments are “Revenue-based”, meaning there is no fixed tenure to this deal. Every time your company generates revenue, a small amount goes towards repayment of the funding amount. Which means if your business does great after the RBF round, you repay the amount faster. In case the sales don’t kick in, you get the flexibility to repay at your own pace.

Make sure to click here and take a look at this infographic that does a good job of explaining how a Revenue-Based Financing deal is structured.

No-equity dilution, 0% interest, flexible repayment schedules, and flexible deal tenures make Revenue-Based Financing the most founder-friendly growth capital alternative.

How does Revenue-Based Financing work?

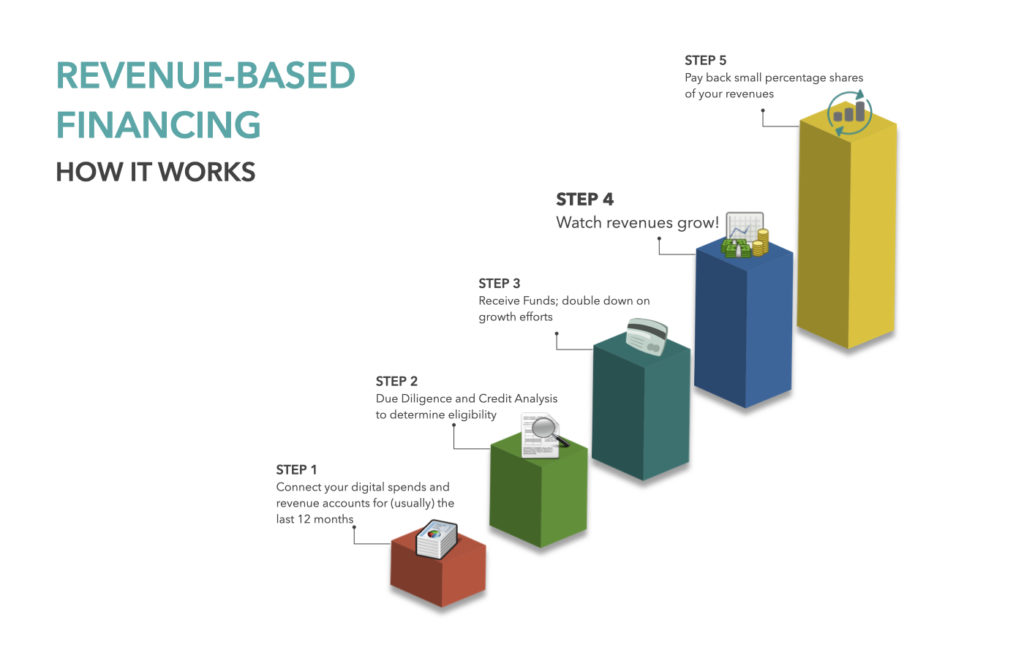

Now that you’ve got a fair understanding of what RBF is, let’s take you through how it works, with the help of another infographic.

Do bear in mind that outlined below is a framework of the process. Every financer innovates upon this framework depending on a variety of factors including but not limited to:

- The sector(s) of business they choose to finance

- The business activity they choose to fund i.e. Payroll, Marketing, Physical Assets, Machinery, R&D etc.

- The extent of digitisation, automation, and technology throughout the process

If you’re not a believer of the “Pictures say more than a 1000 words” adage, there’s a step-by-step for you below.

Revenue-Based Financing step-by-step:

- You share your business’ spends and revenue data for a specified past period (usually the last 12 months).

- A thorough credit analysis of your business’ numbers is done to determine eligibility and further define your termsheet.

- In an equity or debt deal, this would be when you as a founder would be weighing the pros and cons of parting with equity or showing debt on your books. In an RBF deal, you simply skip this step. Revenue-based financing is growth capital in exchange for a % share of your future revenues and a flat fee.

- Step 4 is when you receive funds, with which you double down on your growth efforts and increase revenues.

- As you keep generating revenues, you repay the pre-determined % share of your revenue. You continue doing this until you’ve paid back in full the principal amount plus the flat fee.

A fundraising process this frictionless might just be unheard of so far in this part of the world.

In the coming section, we’ll highlight the benefits of raising Revenue-based capital.

Why you should raise Revenue-Based Capital.

We’ll take a two-pronged approach to this section.

First, we’ll see how RBF holds merit as a financing model and why as a business founder you must consider it as a smart alternative financing option.

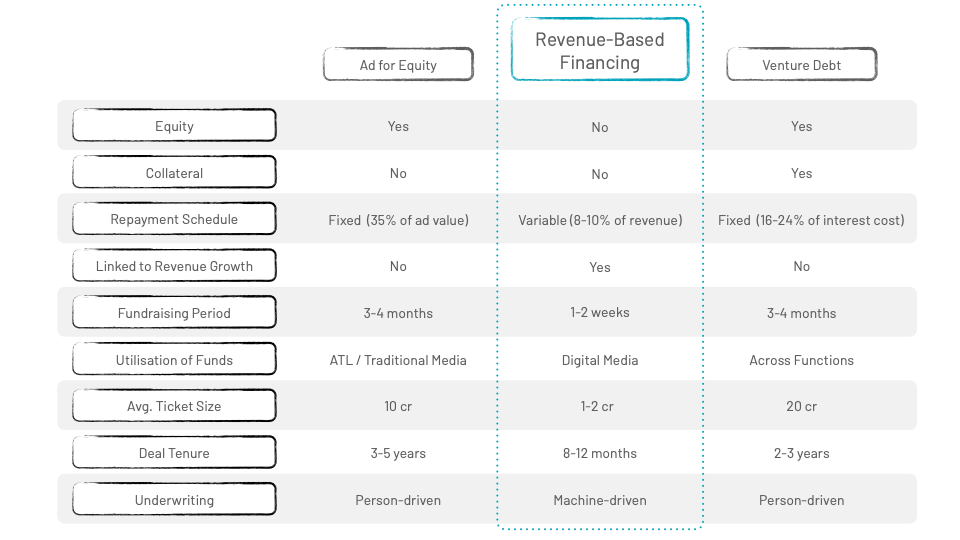

Second, we’ll draw a comparison between RBF, Venture Capital, and Venture Debt to see how the model stacks up against other models of financing.

Starting with one we’ve already talked about a few times.

- Never a bad time for Growth Capital: The fundamental metric an RBF investor looks at is Revenue Growth. So as a founder you can be fairly certain that such a capital infusion will result in growth. Additionally, an infusion of growth capital is welcome at any stage of your business: at the growth-stage, as a bridge round, or even during peak sales season.

- You keep the control: An RBF deal requires no dilution of equity or control on part of the founder. This means no shared ownership and authority and you get to retain the quick and lean decision-making that got you so far. You also save all the time you’d have spent on aligning multiple investors/partners to the same goals and processes. This usually ends up being months’ worth of time. That’s time you could have (and should have) spent focusing on core business activities.

- No fixed repayment tenure: With debt, there’s always pressure to repay the amount within a specified tenure. With RBF, you only pay back a percentage share of a given months’ revenues. You continue doing so until you pay back in full the principal plus the fee. No fixed repayment tenure. No pressure.

- Faster, Fairer, and Frictionless: The typical Venture Capital, Venture Debt, or Bank Loan process can take anywhere more than 4-6 months. Revenue-based financing manages to structure and streamline the entire process to be able to offer up a termsheet in a couple of weeks. It breaks down the process into 4 stages of Application, Due Diligence & Credit Analysis, Disbursement, and Collection. This standardised process is as transparent as it is efficient. Everything is data-driven and therefore there isn’t really any room for biases.

The RBF process comes with a higher degree of efficiency and speed. Revenue-based financing is funds without friction.

On its own Revenue-based financing looks like a smart financing alternative for growing brands. When stacked up against VC and VD financing…it looks just as smart.

Is Revenue-Based Financing Good for your Business?

Right off the bat, this model of financing is a good fit for businesses that already have a minimum revenue history of 6 months.

Owing to the fact that due diligence and credit analyses are conducted on a business’ past revenues, it is imperative that your business be able to provide significant revenue data.

We’ve bucketed RBF-fit into 3 possible scenarios. This is for you to check which bucket your business falls in and how you could approach Revenue-Based Financing.

- You don’t want to / need to raise VC money. Your business economics are inherently positive and cash churning. And you’re a founder who believes in the value over valuation philosophy. If your metrics are so good that you’re not in the market to raise VC money, you should consider an RBF deal for accelerated growth in exchange for nearly nothing.

- You’ve found your product-market fit. You have paying customers, feedback, and you know what works. Now is when you want to double down and growth and ramp up sales and be on your way to raising your first equity round. An RBF growth round could be your ticket to accelerated growth and revenue numbers to make your VC pitch deck even sharper.

- You have already raised a large round. However you want to weather-proof your business and save equity money for a rainy day. An RBF round as a bridge round will let you focus all your energies on growth without going through another cycle of raising institutional capital.

RBF is also fit for businesses across sectors. Direct-to-consumer brands, e-commerce companies, consumer internet brands, subscription services, SaaS businesses, and even mobile apps across the globe have raised revenue-based capital with exponential growth to show.

RBF is a financing solution that’s native to the digital economy and aligns well with the growth objectives of Digital Startups and MSMEs – a new economy financing solution for new economy businesses.

At this point you might have decided to explore raising Revenue-Based capital for your business. There’s 2 things we’d like to tell you about:

- A few considerations while evaluating an RBF deal

- (Finally) A few Revenue-Based Finance providers for you to explore

3 things to consider while evaluating an RBF deal

- Remember to make your own estimate for operational profitability and estimate whether your company can afford to repay the proposed revenue share without sacrificing your net cash inflows by a huge margin.

- While estimating the fee, please take into account that it does not affect your cash flow. RBF players usually operate with one flat fee and no other hidden costs. Do check thoroughly for hidden costs (if any).

- The ease of the entire fundraising process. How quickly and efficiently fund disbursement can take place is quite often a factor of how digitised an RBF provider’s platform is. A frictionless fundraising process could save you weeks. Another major advantage of a digitised platform is Data-driven transparency. Everything is digital and therefore trackable which takes all off the operational hassles and biases out of the equation.

And that’s that. All you need to know about Revenue-Based Financing.

It’s frictionless, founder-friendly, performance-oriented Growth Capital. And it’s here for you to raise. To more Growth!