According to a survey by The National Centre for Financial Education, while India has a literacy rate of nearly 80%, only 27% of the people are financially literate. This means that 70% of the population does not have the basic knowledge to understand financial concepts or how to manage their own finances.

But there’s some exciting tech startups focused on bridging this divide and helping expand financial literacy to more people across india.

Here are some of the ed-fin startups that caught our eye with their purpose-driven approach:

Fampay

Founded by Sambhav Jain and Kush Taneja, Fampay is a fintech startup that aims at providing maximum financial literacy to kids below the age of 18. Children have endless demands and desires but are blind to the amount of hard work and effort it takes for parents to earn money. Striving to inculcate the importance of this very notion, Fampay offers debit cards to children and enables them to spend money under the supervision of their parents. The platform also educates kids about the basics and nuances of finance by offering them various rewards and organising saving challenges, with the purpose of giving them a practical demonstration to practice their finance skills.

KrazyBee

Formed by Madhusudhan E, along with Karthikeyan K. and Wan Hong, KrazyBee is India’s first online installment store for college students. Identifying the financial struggles faced by college-students, the platform offers Semester Loans, E-commerce loans, Two-Wheeler loans, etc. to students in order to help them take care of their financial expenses. All the users are also educated about important concepts like credit score and the possible legal consequences that can be suffered in case they default on their loan. Furthermore, KrazyBee also offers cashback offers and discounts and strives to make the youth financially capable and smart with their services.

GramCover

GramCover is a tech-enabled insurance marketplace for rural customers. Founded by Jatin Singh and Dhyanesh Bhatt, the startup addresses the lack of insurance awareness that exists in rural places. To bridge this gap, GramCover offers simple and easy-to-understand insurance products to rural customers by seamlessly delivering them via a technology platform. The startup has claimed to have over 1 million Indian farmers enrolled on their platform so far, inculcating not only an adequate amount of financial literacy but also digital knowledge in the rural pockets of the country.

Fyp

Fyp is a Gurgaon based fintech startup founded by Kapil Banwari. With an aim to change the pocket money culture in India and make kids financially independent, the platform allows teenagers to do both online and offline transactions securely via the Fyp app and prepaid card. Fyp’s aim is to bridge the financial literacy gap among teenagers by exposing them to important financial management concepts and helping them manage their personal finances to the best of their capabilities.

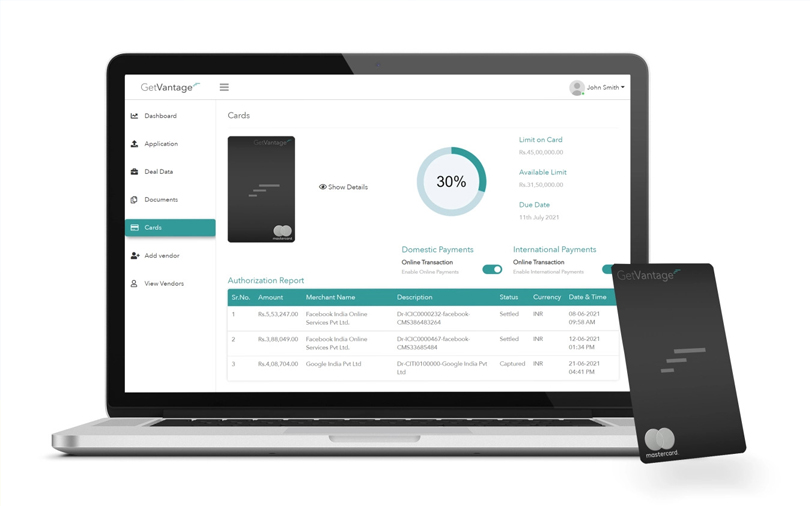

It won’t be incorrect to say that financial literacy is an important life skill in today’s day and age. Moreover, with the rise of fintech, financial inclusion is seen to be much more in practice than ever before. Equal and fair access to financial services across all genders and sectors of life is seen to be the new aim and at GetVantage, we support this initiative wholeheartedly with our data-driven and thus, frictionless fundraising process.

#GetFunded with #GetVantage! For more information, visit http://www.getvantage.co