We’re thrilled to support founders that are mission-driven. Providing access to non-dilutive funding and a support system to hypercharge growth is the least we can […] Read More

We’re thrilled to support founders that are mission-driven. Providing access to non-dilutive funding and a support system to hypercharge growth is the least we can […] Read More

We recently caught up with Bhavik Vasa, founder and CEO at GetVantage, which is India and Southeast Asia’s first revenue-based financing Fintech platform. Vasa talked […] Read More

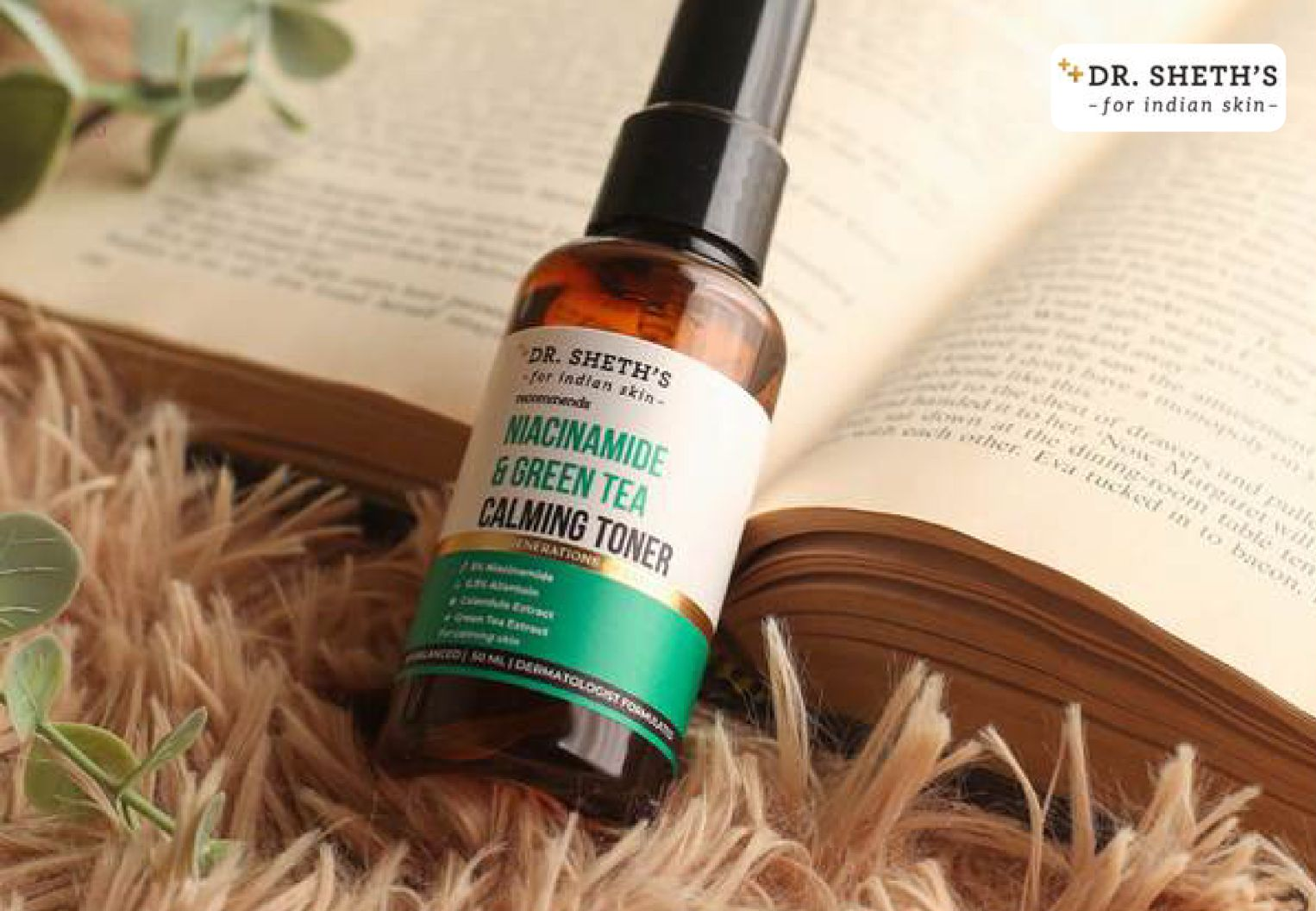

Amid the coronavirus pandemic, there was a surge in online sales as people stayed locked in their homes. Now, even traditional FMCG players are digitising […] Read More

GetVantage financed 40 businesses, while Klub has enabled over 75 rounds of investments over the last year With more and more start-ups turning to revenue-based […] Read More

GetVantage, a fintech platform that provides revenue-based financing (RBF) said it plans to raise $15-20 million, a corpus that will be used to fund more […] Read More

This article showcases Startup Pill’s top picks for the best Lending startups. These startups are taking a variety of approaches to innovating inside of the […] Read More

Led by Chiratae Ventures (formerly IDG Ventures) with participation from Dream Incubator Inc (Japan); capital is a mixture of equity and debt Offers an innovative […] Read More

Commerce and retail have seen a surge in more consumers moving online – leading to more frequent and deeper engagement with brands across every member of the household.

These 4 lessons that promise to set your business on a path to sustainable growth, should you be as brave as Super Mario to follow them.