Originally Published by Mandar Kulkarni on November 28, 2019.

There has been recent buzz globally about a relatively new financing avenue, particularly for early stage Software-as-a-Service (SaaS) businesses. Popularly known as Revenue Based Financing (“RBF”), it entails an upfront financing into the company, while the repayments are a fixed percentage of the monthly revenue until a pre-agreed cumulative amount has been repaid.

Specifically, this makes sense for SaaS businesses as their revenue is predictably recurring in nature. A recent Techcrunch post lists out the active financers in the space, and the typical RBF structures used by them. The average ranges for the criteria and key terms are as follows

| Parameter | Typical range |

| ARR requirement | USD 300K+ |

| Investment size | 2x – 6x of MRR |

| Monthly Repayment as a % of Revenue | 3% – 9% |

| Return Cap (x times investment amount) | 1.5x – 2.5x |

From a financer’s perspective, RBF presents itself as an asset class that has some of the upside of traditional VC, with some level of downside protection like debt.

From an entrepreneur’s perspective, RBF is a non-dilutive financing avenue which can be closed relatively quickly.

Illustrative IRR scenarios for a typical early stage SaaS company

Let’s get down to the numbers to study the relative IRR performance of the three financing structures.

We use the following assumptions:

| Financing amount | USD 150K |

| RBF | |

| ARR | USD 300K |

| Repayment (% of monthly revenue) | 6% |

| Repayment Cap | USD 300K |

| VC Fund | |

| Revenue multiple at entry | 5 |

| Dilution in subsequent rounds | 50% |

| Revenue multiple at exit | 5 |

| Investment Period | 5 years |

| Venture Debt | |

| IRR | 15% |

The IRR profile for various levels of company’s performance (measured by MRR growth %) looks as below

| Parameter | Venture Debt* | RBF | Early Stage VC |

| Financer’s Perspective | |||

| Principal Protection | Very High | High | Very low |

| Repayment Frequency | Monthly | Monthly | One-time (typically) |

| Repayment Predictability | Very High | High | Very low |

| Exit timing predictability | Very High | Low | Very low |

| Upside | Negligible | Moderate | Very high |

| Financer bandwidth requirement | Low | Low | High |

| Entrepreneur’s Perspective | |||

| Existing marquee global VC needed? | Yes (non-starter without it) | No | No |

| Funding amount | Low | Low | High |

| Speed of closure | Moderate | Fast | Slow |

| Strain on cash flows | Very High | High | NIL |

| Headline-grabbing nature? | Moderate | Moderate | Very High |

| Founder Dilution? | No | No | Yes |

*Venture Debt is not very common in early stage SaaS businesses in India yet.

RBF in India – an opportunity for both sides of the table

As of November 2019, RBF was still early in India. Based on our conversations with some of the active US based RBF financiers, they are open to looking at India based SaaS opportunities as long as significant percentage of revenue comes from US based customers, and there is a US subsidiary which generates a certain minimum MRR.

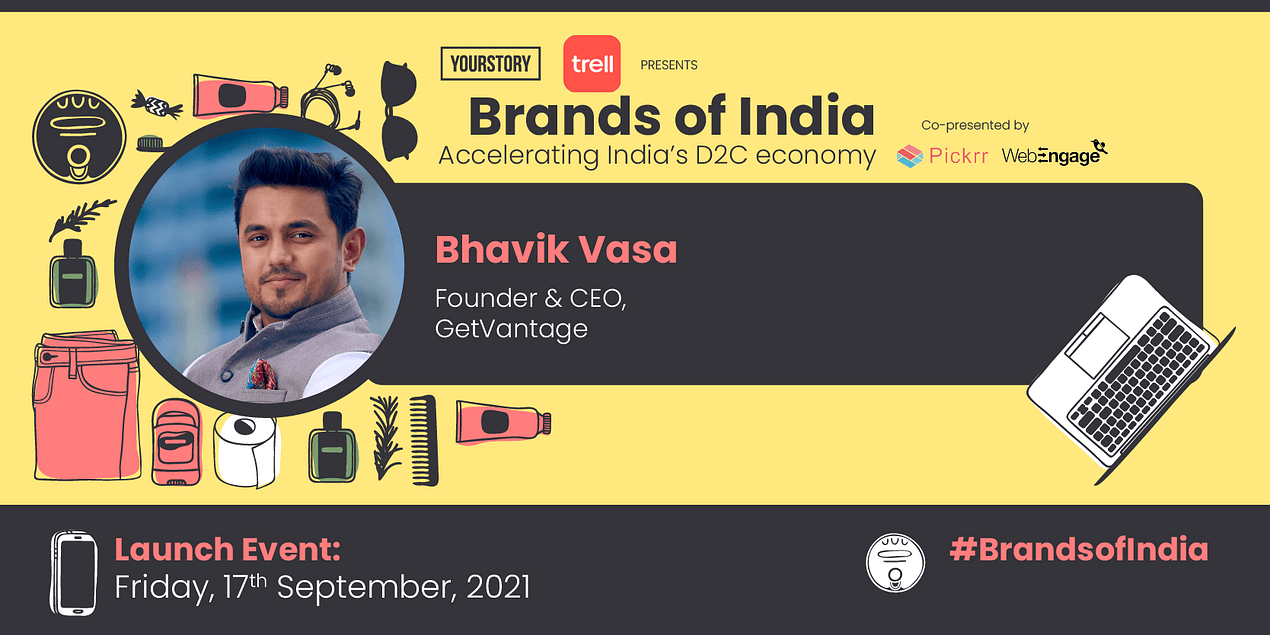

Since then, players such as GetVantage have emerged and are actively looking at working with SaaS businesses and other digital businesses.

Looking at the pros and cons, while RBF may not be a panacea, it indeed looks like an option which the Indian SaaS entrepreneurs will look at with some interest.