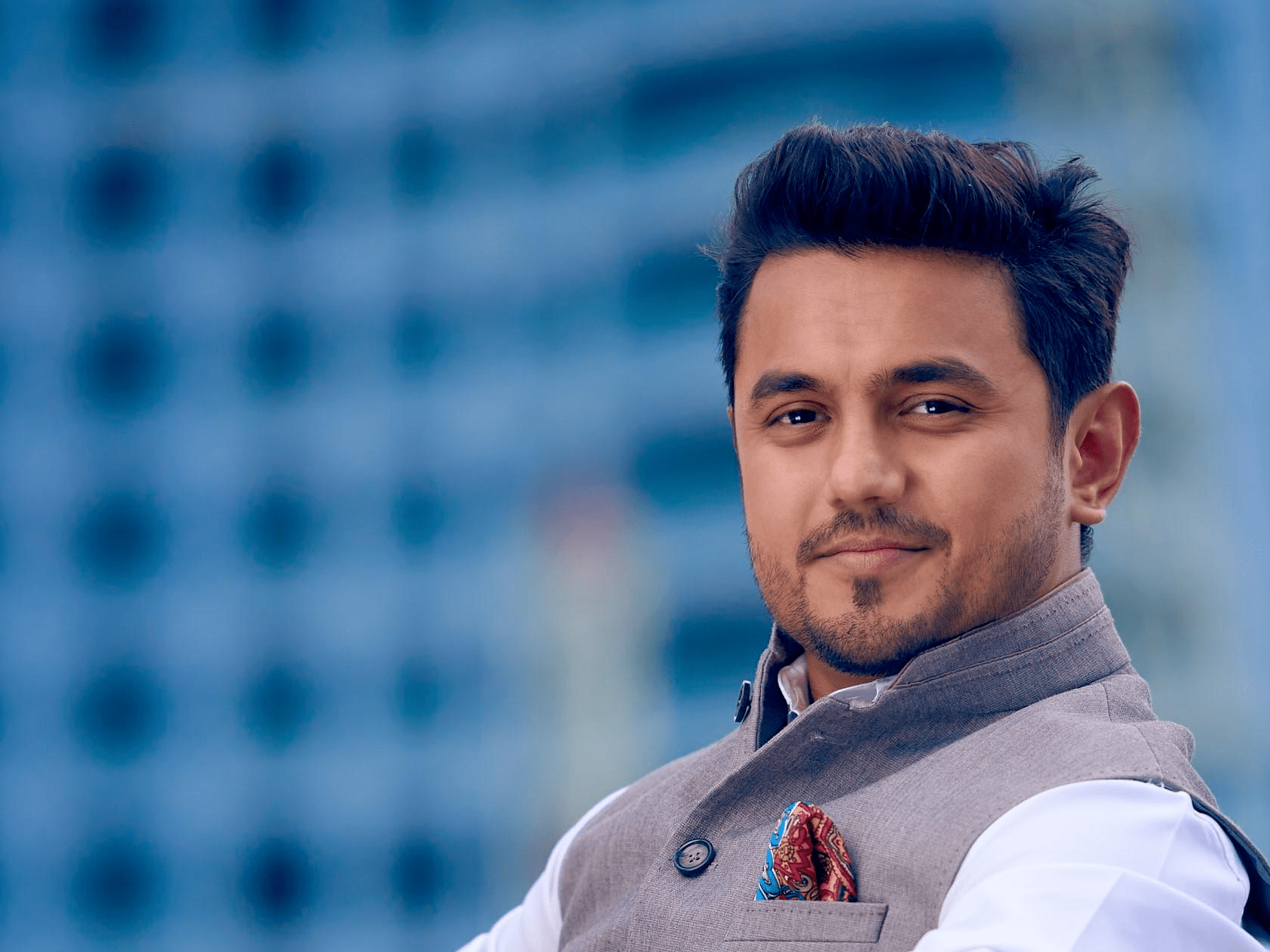

Start-ups or SMBs are always looking for capital to expand and fuel their business. Beyond VCs and loans from banks, revenue-based finance is a fast emerging alternative source of capital for start-ups to fuel their business. Bhavik Vasa of GetVantage explains what revenue-based finance is and how they’re banking on the digital boom.

The pandemic has had a deeply negative impact on small and medium businesses in terms of productivity and business loss. The increase in digital adoption amongst consumers

However, the main challenge for an offline and online business remains the same: access to capital to expand and manage their business. Often these businesses are too small for VCs to invest or founders are not wanting to dilute their ownership to raise funds while taking loans from banks is a lengthy and cumbersome process.