For small firms in India, particularly up-and-coming players in the digital space, getting access to funding is a painful process. Until recently, their access to loans from private banks was limited, and bringing in equity funding from venture capital firms (VCs) and other investors is expensive and complicated.

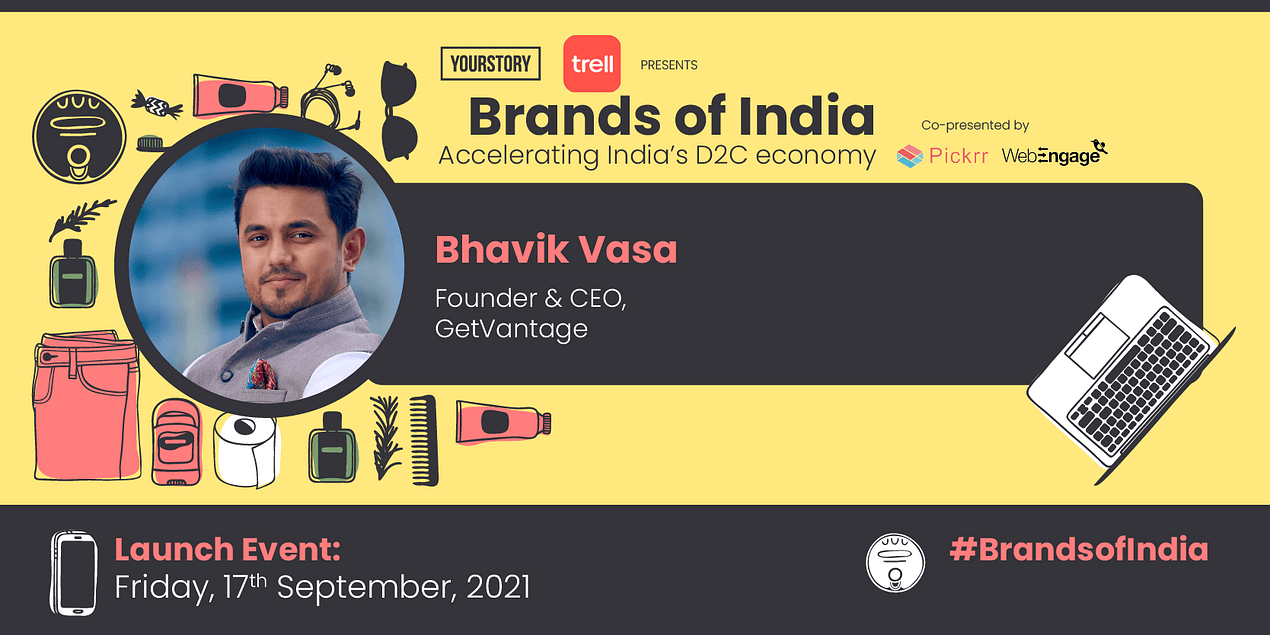

It was a problem of tremendous scale begging for a digital solution in a country with unique challenges. All of these issues attracted the attention of Bhavik Vasa, CEO of a revenue-based financing company called GetVantage. As he told PYMNTS’ Karen Webster in a recent conversation, he knew the cash-access problem in India needed a different model compared to other parts of the world.

“I mean the venture capital model took off really from Silicon Valley for tech businesses,” Vasa said. “But that doesn’t necessarily mean that that model fits all parts of the world, and for all kinds of business. We believe that is the story of India.”